- Credit Processing & Appraisal

- Customer Profile Validation

- Document Collections

- Fraud & Risk Control

- Resource Support & Processing

Credit Processing & Appraisal

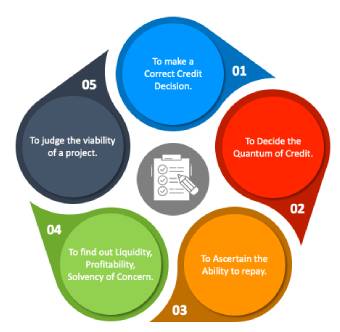

Credit Processing & Appraisal (CPA)

CPA is one of the verticals where we provide the End to End services for Credit and Operations activity for various Retail Assets Products of Banking and Non Banking Sectors. Various product where we offer our services viz. Personal loan, Business loan, Auto loan, Education loan, TW loan, Loan Against property / Mortgage Loan, Commercial Vehicle & Home loan. We are flexible to execute the operations either from Client premises or our premises.

Subsection of Activity we provide in brief :- Login and documents check

- Discrepancy resolution with sales support

- Preparation of Credit Approval Memo as per policy

- Bank statement analysis, data updation in CRM with initiation of required other checks

- For Operation related activity, we health checks of PDC/ECS and Agreements by preparing Disbursal Memo/voucher.

III Personal Discussion of Business and SME Loans

Customer Profile Validation

Customer Profile Validation (CPV)

CPV is one of the major vertical Under CPV vertical, we provide various verification services like – Address Verification, Tele Verification, Document Verification etc. to Banking and Non- Banking Sectors, Insurance Sectors.

We handle major volume of Credit Cards, KYC and Retail Assets Products including Personal loan, Business loan, Auto loan, Education loan, TW loan, Loan Against property / Mortgage Loan, Commercial Vehicle & Home loan etc.

- Applicant Existence

- Address Existence

- Duration of Stay

- Type of accommodation

- Ownership of Residential(Ownership/Rental/Etc)

- Third Parties confirmation

- Applicant working / Running Business at given address

- Duration of working/Business

- Type of Employment/Business

- Third Parties confirmation

TELE Verification

We called up to the applicant / candidate on the given contact number and collect maximum information over phone as well as verify whether applicant is reachable at the given contact number.

I Residence Tele Verification :- Residence contact # confirmation

- Applicant Existence confirmation

- Address Existence confirmation

- Business contact # confirmation

- Applicant working/Business confirmation

- Employment/Business Existence confirmation

We visit to the concerned authorities and verify the documents which applicant / candidate submitted along with the application.

Documents Verification includes the following documents :- PAN Card

- Bank Statements

- Financials

- Salary Documents – Salary Certificate, Salary Slip , Form-16 NOC

We have highly skilled set-up with state of the art technical tools to undertake top quality forensic check of security documents.

As per the market requirement we deliver the Shortest TAT without compromising the quality, to meet Business exigencies of client.

Document Collections

Documents Collection & Reviews (DCR)

Under Document Collection and reviews, we conduct the following activities.

- Document Fulfillment for Retail / Cards Application

- Post Disbursement Documents Collections

- ECS Pick-up & Submission / Activation

- Liability KYC Document Pick-up

- Cheque Pick-up

- PMS Documents fulfillment

Fraud & Risk Control

Fraud & Risk Control Unit (FRC)

Activities conducted under PFRC unit are as below

Employee Background Check :- Address Check

- Education Check

- Employment check

- Reference Check

- Criminal Background Check

- Global Database Check

- Drug Test

I Screening & Sampling Process :

This is Pre – Sanction activity done for Various Retail loan products and in this we do screening of 100% files logged in, and look for any subspecies documents / profile. We collect the samples of those documents up to prescribed percentage of logged in files for Verification and detailed report with findings is submitted in agreed Turnaround time

II Document Verification:We verify the authenticity of KYC / Income and other documents with the issuing authorities which could be the registrar, the hospital, Passport office and other concerned authorities and highlight any mismatch or discrepancy detected (during verification) between the details mentioned on document and that found in the authority

Seeding & Mystery Shopping is an activity conducted to check :- Customer identification process followed by respective Units / Associates

- Apparatus, equipment and infrastructure employed for conducting Activities

- Sacrosanctity of services and approach, process being conducted by Units / Associates

Dealer Stockyard Audit :

- Dealer Stockyard Audit is an activity conducted to check

- To identify or Analyze the Utilization of Funding done by Bank’s / Financial Institute to Dealer’s for their working Capital

- Analysis & Tracking of physical stock available at stockyard, stock in transit and sold Stock

- Re-finance for new additional stock

Investigation :

- Investigation is a Desk check & field check conducted to find out

- Correctness of Documents or Information Provided by any Applicant

- Checking of his background & Involvement in political/illegal activity

- Cross checking his criminal background

- Checking of relationship with business associates of Customer

- Checking of his Lifestyle with connection to his monthly earning

- Previous Employer Feedback checking on his integrity

Resource Support & Processing

Resource Support & Processing

- Recruitment Support

- Statutory Compliances

- Training and Performance Reviews

- Employee Background Checks

- Payroll Management

- Infrastructure Support